TX C-3 BK Instructions 2008-2024 free printable template

Show details

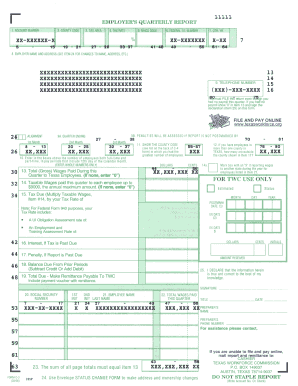

If you need additional continuation sheets to report employees. contact the nearest TWC Tax Office 23. Enter total of amounts listed In Item 22 which should equal Item 13 24 Use the Status Change Form attached to the return envelope to Make employer nformatlon correclions 25. Enter total of amounts listed In Item 22 which should equal Item 13 24 Use the Status Change Form attached to the return envelope to Make employer nformatlon correclions 25. Sign report and enter title. This report must...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your twc form c 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your twc form c 3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit twc form c 3 pdf online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit twc c 3 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out twc form c 3

How to fill out twc c 3 form:

01

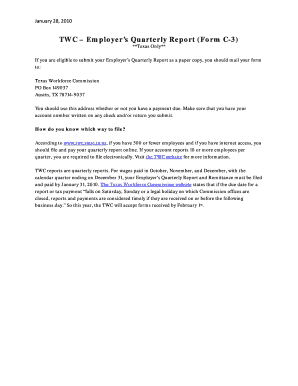

Begin by accessing the TWC website or visiting your local Texas Workforce Commission (TWC) office to obtain the twc c 3 form.

02

Once you have the form, carefully read the instructions and familiarize yourself with the required information.

03

Start by providing your personal details such as your name, contact information, and social security number in the designated spaces on the form.

04

Next, fill in your employment status, including your current job title, employer's name, address, and contact information.

05

If you have multiple employers, repeat step 4 for each additional job you hold.

06

Proceed to the section that requires you to report your wages and hours worked. Here, you will need to accurately enter the amounts you earned and the hours you worked during the specific time period indicated on the form.

07

If you received any benefits or payments related to your employment, such as vacation pay or bonuses, make sure to include these details as well.

08

The form also includes a section that allows you to report any additional income you may have received from sources other than employment. If applicable, provide the necessary information in this section.

09

Review the completed form to ensure all the information provided is accurate and legible.

10

Finally, sign and date the form in the designated area to certify the accuracy of the information you have provided.

Who needs twc c 3 form:

01

Individuals who are employed in the state of Texas and are seeking to report their wages and hours worked to the Texas Workforce Commission (TWC) need the twc c 3 form.

02

Employers may also require their employees to fill out this form in order to ensure accurate reporting and compliance with state regulations.

03

The twc c 3 form is essential for maintaining accurate records of employment and wage history, as well as for facilitating the payment of unemployment benefits to eligible individuals.

Fill texas c 3 : Try Risk Free

People Also Ask about twc form c 3 pdf

What is a Texas Workforce Commission Form C 3?

Why would I be denied unemployment in Texas?

Is there a lawsuit over unemployment benefits in Texas?

How do I contact Texas unemployment appeal?

What disqualifies you from unemployment in Texas?

What happens if you owe unemployment money in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is twc c 3 form?

TWC C-3 form refers to the "Employer's Wage Statement" form that is required by the Texas Workforce Commission (TWC). This form is used by employers to report their employees' wages and other employment information for the purpose of administering unemployment benefits. It includes details such as the employee's name, social security number, wages earned, hours worked, and the period covered by the wage report. This information helps the TWC calculate unemployment benefits for eligible individuals.

Who is required to file twc c 3 form?

The TWC C-3 form is a wage statement that is required to be filed by Texas employers for each employee to report their wages paid during a specific quarter. Therefore, it is the responsibility of Texas employers to file the TWC C-3 form.

What is the purpose of twc c 3 form?

The purpose of TWC C-3 form, also known as the Employer's Quarterly Wage Report, is to report the wages paid and the number of employees working during a specific calendar quarter to the Texas Workforce Commission (TWC). This report helps the TWC determine the employer's liability for unemployment taxes and also helps them monitor and administer the unemployment insurance program in the state of Texas.

What information must be reported on twc c 3 form?

The TWC C-3 form, also known as the Quarterly Wage Report, must include the following information:

1. Employer information: Name, address, and identification number (TWC tax account number).

2. Reporting period: The specific quarter (e.g., January to March, April to June, July to September, or October to December) being reported.

3. Employee details: The name, Social Security number (or TWC-assigned Tracer Identification Number), wages earned, and hours worked for each employee during the reporting period.

4. Total wages paid: The total amount of wages paid to all employees during the reporting period.

5. Employer contributions: Any employer contributions made to unemployment insurance, state employment training, and/or additional premiums (if applicable).

6. Employer's signature and contact information: The authorized employer representative must sign and provide their contact information.

It is important to note that the specific reporting requirements may vary depending on the state and the nature of the employer's business. Therefore, it is recommended to review the instructions provided by the Texas Workforce Commission (TWC) or consult with the appropriate authority for accurate and up-to-date information.

What is the penalty for the late filing of twc c 3 form?

The Texas Workforce Commission (TWC) does not provide specific penalties for late filing of the TWC C-3 form on their website. However, it is important to note that failing to submit required documents by the designated deadline can result in various consequences. These may include delayed processing, potential loss of benefits, or possible penalties determined by the TWC. It is advisable to contact the TWC directly or consult an employment attorney for accurate and up-to-date information on penalties for late filing of the TWC C-3 form.

How to fill out twc c 3 form?

To fill out the TWC C-3 form, follow these steps:

1. Obtain the form: You can download the TWC C-3 form from the Texas Workforce Commission (TWC) website or request a copy from your employer or local TWC office.

2. Begin with personal information: Write your first and last name, address, phone number, and social security number at the beginning of the form.

3. Provide employment details: Fill in your employment information, including the date you began working for the employer, your job title, and your supervisor's name. Indicate whether you are a full-time or part-time employee.

4. Enter your separation details: Indicate your reason for separation from employment by selecting the appropriate box. If you were laid off, terminated, quit, or other reasons specified, state the relevant details in the space provided on the form.

5. Sign and date the form: Sign and date the form after completing all required sections. By signing, you certify the accuracy of the information provided.

6. Additional information if applicable: Depending on your situation, you may need to provide additional information or documentation along with the TWC C-3 form. For instance, if you quit your job, you might need to explain the reason for quitting and provide supporting documentation for your claim.

7. Submit the form: After filling out the form, submit it to the appropriate authority. If you are unsure where to submit the form, contact your employer or local TWC office for guidance.

Note: It is essential to carefully read all instructions provided on the form or seek assistance from the TWC or your employer if you have any questions or concerns while filling out the TWC C-3 form.

How can I send twc form c 3 pdf to be eSigned by others?

When you're ready to share your twc c 3 form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make changes in form c 3?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your tx c 3 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in c 3 form texas without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing texas workforce commission form c 3 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Fill out your twc form c 3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form C 3 is not the form you're looking for?Search for another form here.

Keywords relevant to texas form c 3

Related to c 3 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.